Why The Crypto Market is Currently Trending (What to Expect)

Every penny you spend has a significant impact in the economy and it doesn’t even matter if it is N1,612 I mean $1. well, I could give you several gibberish that could convince you about how true this statement is but it would most likely confuse you.

Let’s then stick with this: every economic move such as an increase or decrease in interest rate, by major players like the United States of America, China, Germany and Japan spells gloom or doom for the rest of the world or for some asset classes which includes Cryptocurrency.

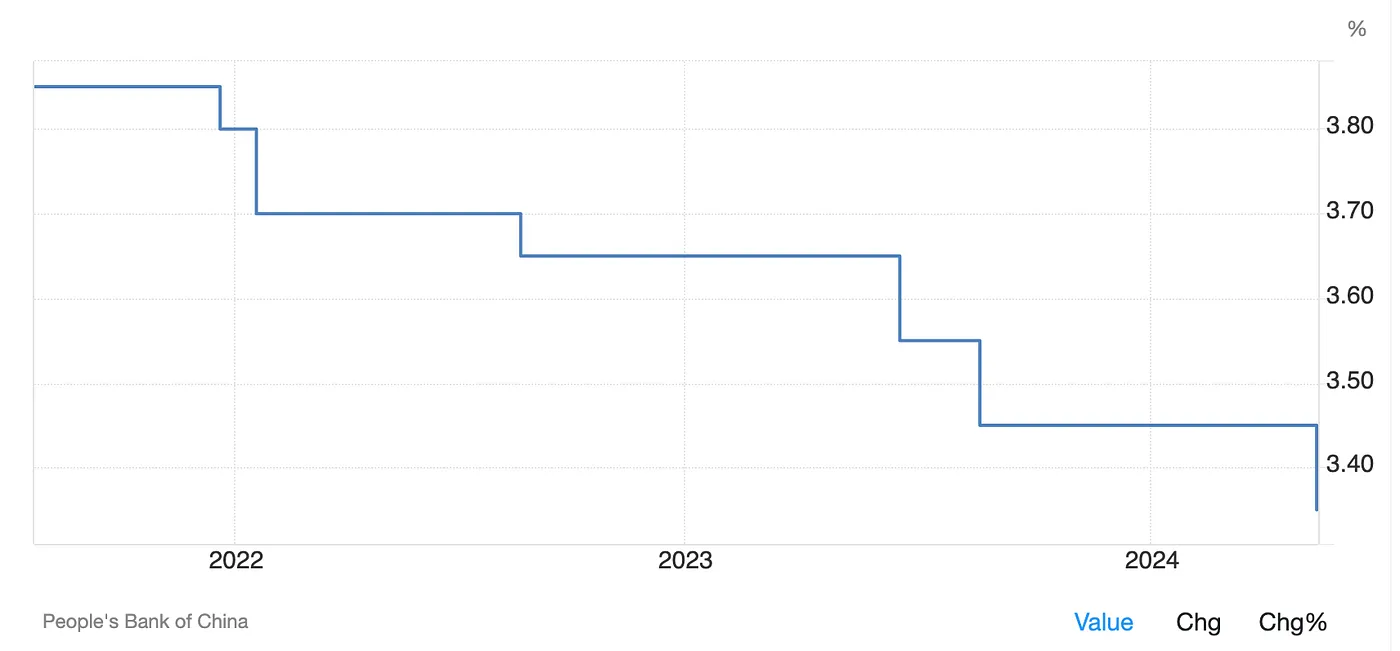

China’s decision to cut interest rates has far-reaching implications beyond its borders. With lower interest rates, the cost of borrowing money decreases, encouraging businesses and individuals to take on more debt. This influx of liquidity often finds its way into riskier assets, including cryptocurrencies. Investors are more willing to place bets on high-reward options like Bitcoin and Ethereum, leading to an increase in demand and, consequently, a price surge.

As it has been established previously, China is one of the world’s largest economies, and when it loosens monetary policy, it signals a potential boost in economic activity. This renewed confidence extends to the global crypto market, where investors are more likely to enter or increase their holdings, expecting higher returns.

Above is the Weekly live chart of the BTCUSD showing a significant breakout of the downtrend which began an uptrend run after the country’s interest rate cut. Therefore by lowering key interest rates, the People’s Bank of China (PBOC) aims to stimulate economic growth and increase liquidity.

This move has several effects on the crypto market:

- Increased Liquidity: Lower interest rates mean more money is available for investment, which can lead to increased buying activity in the crypto market

- Investor Confidence: Rate cuts can boost investor confidence, encouraging them to take on more risk, including investing in cryptocurrencies

- Global Influence: China’s economic policies often have a ripple effect globally. As one of the largest economies, its financial decisions can influence global markets, including cryptocurrencies

These factors combined have contributed to a surge in cryptocurrency prices following China’s rate cuts

Now what should you expect in the coming weeks and months or Q4 generally? expect another rate cut